|

| 友情链接 |

|

|

| |

首页 -> %EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD 首页 -> %EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD%EF%BF%BD |

|

|

| Intellectual Property, Innovation and Investment in Clean Energy: Exploring U.S.-China Perspectives |

Second Joint Workshop on Intellectual Property in the Second Joint Workshop on Intellectual Property in the

U.S.-China Clean Energy Research Center (CERC)

February 26-27, 2013

Stanford, California

Workshop Summary

Prepared for the U.S.-China Clean Energy Forum

by Joanna Lewis1

1 Joanna Lewis is assistant professor of Science, Technology and International Affairs at Georgetown

University's Walsh School of Foreign Service, Washington, DC, and observer of the workshop.

2 More information about the U.S-China Clean Energy Research Center is available at http://www.us-

china-cerc.org.

May 8, 2013

On February 26-27, 2013 at Stanford Law School, the Stanford University Steyer-Taylor Center

for Energy Policy and Finance, the U.S.-China Clean Energy Forum, and the China Science and

Technology Exchange Center co-hosted the second workshop for participants in the U.S.-China

Clean Energy Research Center (CERC) to examine and discuss issues related to intellectual

property in clean energy collaborations.2

This workshop was a follow-up to the first IP workshop that took place in Haikou, China in

March 2012 and expanded upon many of the themes raised there, particularly differences in

Chinese and U.S. laws for the protection of intellectual property. This meeting also presented new

case studies of firms’ experiences navigating IP landscapes to protect their clean energy

inventions in both countries. Also new to this workshop was an opportunity for CERC

participants to ask specific questions of the IP professionals present related to their ongoing

research collaborations.

Summary of Key Workshop Findings

Several key themes arose during the workshop presentations and discussions, which are

summarized below.

. China has more individual patent owners than the United States, and this has implications

for innovation and IP protection. There are increasingly incentives for individual

researchers to benefit directly from their inventions, which was not the case in the past.

However, the large number of owners in China means there is also a risk of abusive

litigation from non-practicing entities.

. China has enhanced its own IP protection primarily due to an increased demand for

protecting domestic innovations.

. There are many examples of innovations from elsewhere being commercialized in China,

particularly in pharmaceuticals, but this is increasingly true for clean energy as well.

. While U.S. PTO programs that aim to make it quicker and cheaper and easier to patent

clean technologies can be useful (like the fast track system, green technology pilot

program or patents for humanity programs), there are still real problems after the patent is

issued in the form of excessive ligation or “patent thickets.”

. Non-practicing entities (NPE or “patent troll”) are companies entirely in the business of

lawsuits, primarily asserting patents they’ve acquired from another party. NPEs file over

half of all patent lawsuits in the United States. They frequently target startups that cannot

defend themselves from litigation.

. NPEs are a significant issue in the United States; however, they may find China a more

difficult legal environment to win cases because China’s courts require the patent holder

to show the damages they suffered.

. Many firms are concerned about bringing “Easy IP” to China, even if it could have

valuable applications there. IP that is easier to copy is frequently also easier to enforce in

court since it easier to provide evidence to prove the infringement.

. While trade secrets can be difficult to protect because they are easy to lose, there are

many simple actions firms can take to prevent loss, including disabling the use of USB

drives or monitoring emails for large attachments.

. Trade secret protection presents a particular challenge in the Chinese context, due to a

lack of mature legal protections for trade secrets. This is a problem because many

companies rely on trade secret protections instead of patents when they want to keep their

invention secret.

. Agreeing to the terms of an IP agreement may take time, but it worth the time upfront to

come to full agreement prior to beginning work in order to avoid misunderstandings,

disputes, or at a minimum, having to go back and reopen an agreement for negotiation.

. It is as important to be selective in choosing your business partners in a bilateral venture

as it is in undertaking a domestic venture. You want to make sure that your interests are

aligned, and once in negotiations, make sure you have mutual understanding.

. There are many reports of misperceptions between Chinese and U.S. firms due to cultural

differences, and a lack of understanding of each other’s IP rules and legal systems. This

can lead to differences in understanding of terminology being discussed that may have

different legal interpretations and different cultural contexts (such as “exclusivity” and

“technology transfer,” among others).

. Collaboration may be crucial for the survival of small companies, particularly if other

firms bring IP infringement cases against them. Collaboration was also identified as

being crucial to driving down costs and sharing RD&D costs.

. There are major differences in the discovery process in China and the United States.

While many believe the process is too cumbersome in the United States, in China it is

believed to be far too brief. Although in the United States parties can be compelled to

produce information that is adverse to their case, the same is not true in China.

. Joint Ventures (JVs) come with a unique set of IP protection concerns. The dual

ownership structure makes it even more important to work out IP arrangements between

the parent firms, planning ahead for how to handle things when/if the JV dissolves.

. There is increasingly extensive coordination between the U.S. and Chinese patent offices

which is being reflected in a gradual increase in consistency between the two legal

systems. In addition, the United States Patent and Trademark Office (USPTO) and the

State Intellectual Property Office of the People’s Republic of China (SIPO) Patent

Prosecution Highway (PPH) pilot program began on December 1, 2011 and streamlines

the patent application process for inventors filing in both systems.

. “Innovation parks” are being used in China to promote international R&D cooperation

with over 10 parks established to date, including the China-U.S. (Wuxi) Science and

Technology Innovation Park, and this model could be expanded in the future.

. The CERC should be more widely understood in both countries as it may serve as a

model in addressing IP in bilateral relations and its work on IP has value in cutting

through the “fog of misunderstanding” around IP issues.

Summary of Presentations

Summaries of the presentations made by the participants from the U.S. delegation are described

below. For further details the original presentations are available on the CERC website for

review.

Day 1

1. Welcome

Dan Reicher from Stanford University began the conference by welcoming participants. He noted

that U.S. Energy Secretary Steven Chu would soon be returning to Stanford as a professor.

Remarking that the clean energy sector had transformed from a collection of small companies to a

group of truly multinational players, Reicher said that allowing this globalization to continue,

rather than fighting it, will be a key element of this sector’s future growth. Since the protection of

intellectual property (IP) will be important for this to happen, IP issues need to be worked out in a

constructive, forthright way. He hoped this workshop would promote constructive discussion of a

contentious issue with hard-hitting implications, and with important implications for our

companies’ and countries’ competitiveness. He noted that Stanford has a tradition of encouraging

debate about important ideas, and that he hoped the participants could use this workshop to talk

frankly, and not just about legal theories but about business realities; and not just about IP but

about the broader relationship between the United States and China on clean energy. He hoped

that this “talk” could be turned into action, and that participants would come out of this meeting

with suggestions for real resolutions to IP problems.

Dennis Bracy from the U.S.-China Clean Energy Forum welcomed participants to the meeting

and thanked the organizers for many months of preparation for this workshop. He commented

that while “IP” usually refers to “intellectual property,” it could also stand for “innovation

promotion,” since the two are related, and innovation promotion is what we are trying to do in the

context of the CERC, as well as furthering our common goals to promote clean energy

technology development.

Bi Gang, the Deputy Consul General of San Francisco, noted that climate change has been a

critical part of U.S.-China joint efforts since turn of the century. He called the CERC an

important opportunity to deepen bilateral cooperation in emissions reduction, clean energy and

environmental governance, and mentioned that it had become a highlight of U.S.-China

cooperation. Recalling the November 2009 Presidential launch of CERC, he noted that the teams

have since joined R&D forces, worked closely together under the CERC framework, and

achieved much progress. The fact that industries, universities and research institutions had joined

consortia as equal partners was unprecedented, and marked the start of a new phase in bilateral

cooperation. These actions enhance joint efforts on climate issues and therefore contribute to the

United Nations Framework Convention on Climate Change’s call for strengthening technical

cooperation between countries. He commented that cooperation under CERC reflects our shared

interests in seeking innovative solutions and developing major new clean energy innovations, as

well as a friendly cooperative spirit between our two countries.

2. Opening Remarks

Energy Forum

Dennis Bracy introduced the U.S. and

Chinese CERC Directors. He noted that the

CERC model did not require a new building,

but instead taps into the greatest minds to

create a virtual organization. Coordination of

such an organization, however, is no small

task, particularly when it merges languages,

cultures, and hundreds of scientists. This

coordination is accomplished by Robert

Marley and Liu Zhiming.

Robert Marlay, the U.S. CERC Director from the

Department of Energy, welcomed all participants, noting

that the large number of participants that came over from

China (55) indicated the importance of the topic and the

seriousness of their commitment. Dr. Marlay spoke of

CERC’s amazing lineage as a Presidential initiative,

chartered by the two most senior science officials in the

United States and China, Wan Gang and Steve Chu. Organized under a novel government-to-

government agreement, the CERC includes $150 million jointly pledged over five years, and an

IP annex designed to facilitate the allocation and management of IP.

Dr. Marlay reminded us that the United States and China are the world’s two biggest economies

and the biggest consumers and producers of energy. We depend heavily on coal, import much of

our oil, and are responsible for about 40% of the world’s greenhouse gas emissions. Since much

of our infrastructure is yet to be built, it can be influenced by what we develop in the CERC. Both

countries see scientific discovery and innovation as a way to inspire economic growth and

improve the quality of life of our citizens, and we both have great capacities for solving problems,

so we have many reasons to work together. The main premise of CERC is that we can tackle

these joint challenges faster and more cheaply if we can figure out new ways to work together.

The CERC has three tracks, focusing on different technology areas, and all the CERC directors

were in attendance at this workshop. Dr. Marlay stated that the CERC currently consists of 88

individual projects within these three tracks, and that almost all of these projects are joint

collaborations between U.S. and Chinese researchers, nothing that the goal is for all projects to be

joint, and to be “collaborative,” and not just “cooperative.” He estimated that 1,100 researchers

in the U.S. and China were supported by the work of the CERC, and that 100 partners were either

contributing funds or directly performing research. He noted that there are already signs of

success across these projects, as reported at a recent meeting in Washington. He also noted that

more and more industrial partners and business ventures wanted to join the CERC, and that many

were offering funds or in-kind contributions to join. In addition, other countries are beginning to

take notice of the CERC and are looking to build on this model.

Dr. Marlay emphasized that support of the CERC from the highest levels of the two governments

and particularly an endorsement of the IP protection framework both allows for oversight and

encourages compliance. In addition, he discussed there being real advantages to doing

cooperative work under a government-to-government agreement, and that protecting IP ensures

everyone brings their best information to the collaboration. He mentioned that four independent

evaluations of the CERC had been conducted, including one by the National Center for Science &

Technology Evaluation of China (NCSTE) sponsored by the Ministry of Science and

Technology. He said that the evaluations had called CERC a “milestone initiative” that is both

pragmatic and win-win, and that it “enables a new kind of relationship built on mutual

understanding and trust,” referring to the Technology Management Plans (TMPs) as

“groundbreaking.”

He concluded by asking the workshop participants to consider how this conference can build on

the one in Hainan; whether we can strengthen the practice of IP and it’s protection, and whether

we can apply the CERC model without high transaction costs. He also asked whether, when we

face serious challenges, our agreements will hold up, or if there are sticking points that we need

to fix. Finally, he asked whether the CERC IP framework might be extended to other endeavors

in science and international affairs.

COUNSELOR LIU ZHIMING, CHINA CERC DIRECTOR

Liu Zhiming, the China CERC Director from the

Ministry of Science and Technology (MOST),

welcomed the workshop participants, thanking Stanford

and the China Technology Exchange Center. Noting that

the Hainan conference had contributed to fruitful

communication and exchanges on IP, he said that he

hoped good progress could continue in this area.

Providing an update since the last workshop, Counselor Liu noted that collaborations have been

strengthened and more importance has been attached to IPR based on the TMP’s foundation, and

he called for an expansion of the consortia and of the outputs of R&D. As we jointly face the

climate change challenge he hopes that the CERC will deepen our understanding and facilitate a

model for IP protection and joint research in clean energy.

3. Opening Remarks on Innovation and IP Protection

MA WEIYE, DIRECTOR GENERAL OF THE

DEPARTMENT OF PATENT ADMINISTRATION IN

THE STATE INTELLECTUAL PROPERTY OFFICE

OF THE PEOPLE’S REPUBLIC OF CHINA

Ma Weiye, Director General of the Department of

Patent Administration in the State Intellectual

Property Office of the PRC, spoke about the status

and motivations for IP protection in China.

First, he explained that China stresses IP protection as part of Former President Hu Jintao’s plan

for an innovation-driven path for the country. He noted that IP and innovation are related, since

IP is the result of innovation, and that if IP is not protected a lot of innovators will lose their

passion to innovate. Therefore he believes that China has enhanced its own IP protection

primarily due to its own domestic innovation needs, rather than due to international pressure.

Second, he discussed China’s emphasis on judicial and administrative enforcement of IP

protection, noting that administrative remedies were often more effective than judicial. He noted

that beginning in October 2010 the government began to crack down on IP infringements.

Third, he noted some achievements within China’s IP protection system, as measured by cases of

infringement tried in court and damages paid. He also noted that the volume of patent

applications has risen steadily in China as innovators believe that domestic IP protections can

help to protect their innovations.

Fourth, he commented on future directions in Chinese IP law, including a need to continue to

deepen and enhance protections. He predicted that judicial protection would be expanded, and

administrative enforcement would be improved. He also noted that with such enhanced IP

protections, China would likely see an increase in cases of infringements. He ended by observing

that an enhanced IP system in China could help lead U.S.-China collaborations involving IP.

MARK A. LEMLEY, DIRECTOR OF THE STANFORD

PROGRAM IN LAW, SCIENCE AND TECHNOLOGY

Mark Lemley, a Professor at Stanford Law School

professor and an attorney with Durie Tangri LLP,

mentioned recent developments in the United States

designed to promote clean energy innovation, including

the U.S. Patent And Trade Office’s (PTO) Green Energy

Pilot Program and the Patents for Humanity Program. He

said that while both programs aim to make it quicker and

cheaper and easier to patent clean technologies, some of the real problems occur after the patents

are issued, particularly related to ligation, noting that patent litigation has been expanding in

many sectors in the U.S. (though primarily outside of the energy technology sector). While most

lawsuits in energy are from companies that enforce a patent only once, in other sectors there are

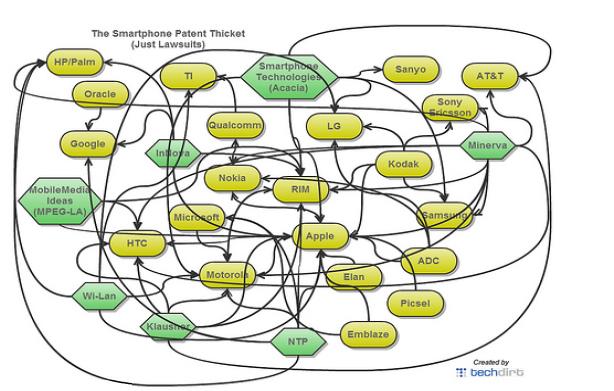

multiple lawsuits from multiple corporations, leading to a “patent thicket” or complex web of

lawsuits where multiple companies are suing each other.

Fig 1. The Dangers of a Patent Thicket.

Source: Presentation given by Mark Lemley, Stanford Law School (original image from Techdirt.com).

Another issue is that of “patent trolls,” or companies entirely in the business of lawsuits,

primarily against patents they’ve acquired from another party. The United States has made

modifications to the law recently to make this somewhat more difficult.

eBay v. MercExchange Case (U.S. 2006) granted injunctive relief to patent trolls trying to shut

down the technology. Since ITC still has the power to grant injunctions to patent trolls, growth of

filings has been substantial. Patent trolls are responsible for more than half of assertions made in

the ITC. While software patents are the primary target, trolling is common in most industries

where too many patents have been granted on too simple or too many elements of the invention.

Patent trolls increasingly target startups, since they are generally not able to defend themselves

against litigation.

Lemley clarified that despite all of these problems, he is not suggesting that patents or patent

litigation are bad ideas. They are important for the role they play in providing startup capital, and

provide a valuable signaling mechanism. Economic espionage and copying are real threats that

they can protect against. But the solution cannot only be obtaining more patents more cheaply. It

is also necessary to make sure that patents promote technology transfer and the development of

innovation, and not impede it as they have done in software industry.

In the Q&A session, panelists asked how China is dealing with the problem of patent trolls. It was

suggested that there is even more of a risk of abusive litigation from non-practicing entities in

China because there are even more inventors, although this has not become a major problem yet.

If patent trolling isn’t illegal there isn’t much China can do administratively, though the judges

may be able to influence this.

Also discussed was the topic of whether different sectors or types of inventions had different

manners of protecting IP due to different characteristics. Lemley mentioned that for inventions

which are hard to copy, or rely on process expertise and trade secrets, the inventors sometimes

delay or forego patent protection in favor of keeping their invention secret for a period of time.

For that to work, he said that we need robust protection of trade secrets in all countries concerned.

The costly nature of an invention may make it harder to imitate and reduces risk of copying, but it

also means the inventor must make a substantial investment in the technology, and requires some

investment in the technology to recoup their investment.

4. Panel 1: Bringing IP from the United States to China

(LEFT TO RIGHT) HE JING,

DR. ZHAO GANG AND

FRANK LANDGRAFF.

Moderator: He Jing. Partner,

Beijing Anjie Law Firm.

He Jing invited both

panelists to share their

insights from working in

China and the United States, and what the key concerns are with respect to IP.

Frank Landgraff, Senior Intellectual Property Counsel, GE Power and Water.

Landgraff pointed out that in most smartphones there could be around 250,000 patents; whereas

in GE’s power generation business, one commercial wind turbine would have about 250-300

patents, so the scale is different. GE Power & Water, with approximately $28 billion in revenues,

requires management of large patent portfolio of about 30,000 patent assets, almost half of which

are U.S. or Chinese assets. Landgraff discussed GE’s technology transfer models in China, which

include either setting up a JV with a Chinese partner they identify, or (as in the case of their

gasification business) a straight license, which is done on a plant-by-plant basis in China. He

described GE’s patent portfolio as the part of the iceberg above the water and that the real

development of their IP portfolio is protected by trade secrets, noting that there are pros and cons

to this. In transferring technology to any third party be it in China, India or Europe, they must

manage the transfer of trade secrets. This requires needing to be able to enable GE’s partners to

practice the technology they are transferring, while preventing the information from being

disseminated to other parties in the market and used to complete against them. Even when

transferring technology, GE generally continues to develop these technologies. This requires

investing smartly in technologies so that they are constantly getting better, and this is how they

try to stay relevant in the market. If they were not funding further tech development it wouldn’t

be long until others had the similar technologies.

Landgraff addressed how to enforce and prevent third party misappropriations, stating that GE’s

strategy is to work closely with their Chinese partners to ensure that misappropriation doesn’t

happen. He said that while he believed that this is against their Chinese partners interests as well,

in reality it can be difficult to enforce. He mentioned that having a great contract helps but it’s not

sufficient because technology can get proliferated into the market very quickly. He recommended

figuring out systems where trade secret enforcement becomes easier. One issue he mentioned is

that the United States has a state law approach so to trade secret enforcement so it varies state to

state which is challenging, and noted also that there could be improvements made in trade secret

protection as well.

Zhao Gang, Director, Chinese Academy of Science and Technology for Development, Ministry

of Science and Technology.

Zhao’s presentation highlighted many S&T achievements made by Chinese companies and the

role of technology transfer with foreign firms. He mentioned the case of the East China

University of Science and Technology being able to develop their own coal gasification

technology through 20 years of R&D. As a result they compete in the foreign marketplace against

companies like GE and Shell and have successfully won a contact with Valero (a U.S. oil

company) in which they licensed their technology to the United States. He also mentioned several

Chinese government policies that aim to encourage foreign enterprises to invest in R&D activities

within China. He believes that technology transfer isn’t as unidirectional as before, and that there

are increasingly examples of Chinese transfers to the United States. However, he said that

Chinese companies often have a hard time navigating the U.S. patent system and this can

sometimes prevent technology transfer from China to the United States. He thinks the same is

frequently true for U.S. companies trying to bring technology to China, where they aren’t familiar

with Chinese IP protections.

When asked whether technology transfers between universities and companies occur in China as

do frequently in the United States, Zhao mentioned that there are several S&T demonstration

zones, including in Beijing, Shanghai, and Wuhan, that were set up to encourage these sort of

arrangements. One way this is done is by awarding university researchers higher percentages of

IP ownership. In the past, individual researchers could only own about 20% of the IP while

universities keep the rest (80%) but now the ownership for the individual researchers are higher,

(40-50%) and there’s talk about increasing this to change the incentives.

Landgraff elaborated on this point, agreeing that it is good to involve individual researchers in the

intake of IP. He said that they frequently work with universities when they are home to the

leading technologists in a certain field, and it is important for these researchers to have a vested

interest in the success of the invention. He believed that in the U.S. professors are rewarded well

in technology transfer agreements.

Landgraff also said that part of the complication with IP between the United States and China

tends to come from the fact that each side doesn’t understand each other’s IP legal systems

sufficiently. One of the largest IP management issues is related to trade secret misappropriation,

particularly when employees move to other companies. GE invests over $4 billion annually in

R&D, and, if they are not able to recoup this investment, or if a company is able to utilize their IP

without a similar investment, that third party is at a big advantage in the marketplace.

When asked about how GE handles IP related to technology improvements, he said that this

depends on the technology. For example, in gasification, if the licensee improves the technology

they ask for a grant back license, and they then flow the improvements from any individual

license back to all the other licenses. In addition, he discussed the role of companies

commercializing R&D outputs, which he thinks is something that companies can do better than

governments, which invest primarily in basic research.

Another issue raised in discussion was how foreign licensors deal with the fact they must warrant

any technology they bring into China. If this isn’t addressed legally the firm may be taking on

unlimited liability. Landgraff mentioned that GE addresses patent indemnification this on a case-

by-case basis, and it will become clearer how various agreements can or cannot be enforced under

Chinese law as cases are brought to trial. The issue of whether or not a foreign firm might decide

to pursue a patent infringement case in China due to broader political repercussions was also

discussed. Landgraff said that GE would decide to do this if it was the right thing to do, and they

have done it in the past.

5. Panel 2: IP in a U.S.-China Joint Venture

(LEFT TO

RIGHT) GUO

WEI, HE JING

AND WILLIAM

LATTA

Moderator: Guo Wei, Department of Science, Education, Culture and Health, Legislative Affairs

office of the State Council

William Latta, LP Amina

Latta gave a brief background of LP Amina, a company founded in 2007 that is focused on

pollution control, with active projects in the U.S., China and Mexico. They have 100 full time

employees and up to 300 employees based on specific projects. Their technology includes NOX

abatement for coal fired power plants. They are active in R&D. The company has partnerships in

China, Germany and the U.S. to develop clean coal technologies, 1 of which is to the point of

commercialization. To commercialize this technology they are working under the CERC

platform, with the Chinese company Ge Meng based in Shanxi province (Taiyuan). Ge Meng

Electric Group is 47% owned by Shanxi Province, and the rest is owned by Korean Power and

Deutsche Bank.

He Jing: Beijing Anjie law firm.

He’s firm works with companies developing JVs in China. He said that one key issue in the

development of new technologies is a establishing a governance structure across the labs and

universities involved. He mentioned these joint research collaborations aren’t legal entities or

limited liability firms, so this is a problem when it comes to accountability. Another issue is

related to funding, and how firms allocate their resources across different stages and manage it

well. He discussed the problem in establishing initial agreements, particularly when firms hold

back valuable information prior to agreement being reached, but that this can breed a lack of trust

on both sides.

Latta elaborated on LP Amina’s JV in Shanxi. He mentioned that they have been active in China

since 2008, and have projects in 15 provinces working with coal plants across the country. As a

result they had a reasonable assessment of IP protection and some of the issues in China prior to

entering into their JV. He said that he believed IP protection is possible anywhere in the world,

but the ways to go about it in different contexts are different. He said that mutual understanding

between parties is key to be able to get to the real issues about how to set up a framework that

protects both parties’ interests. Their own JV agreement was established in summer 2012 and is

expected to be operational by summer 2013. While they are still in the early stages of their

collaboration, so far their IP strategy has proven robust. They constructed it by soliciting good

advice including from large MNCs, and by building on their past practices.

(LEFT TO RIGHT) HE JING AND WILLIAM LATTA

He Jing elaborated on the issue of non-patented proprietary

technology, including trade secrets. He explained that in the

process of creating the JV, very often both parties rely on NDAs

or other confidentiality agreements to create an environment for

both sides to share information about what know-how they have.

It is common for new/immature technologies for few patents to be

available. He referred to a recent amendment in China of the civil

procedure law (March 1, 2013) that now offers preliminary

injunction for contractual and trade secret cases. In the past,

Chinese law only permitted this for patent and trademark and

copyright cases. This allows companies to go to court to seek

injunction or ask for monetary damages. While he believes that there are still some real concerns

about enforcement and local protectionism, there are new legal tools available in the Chinese

context which may give more confidence to technology owners when they make their disclosures.

As a result, he mentioned that there are now several high profile trade secret cases among JVs

being litigated in the Chinese courts. While patent infringement cases are normally not between

business partners, in trade secret cases they often are. He said that the Chinese court (particularly

IP judges) is getting more experienced with IP cases, and therefore litigating in China may in

some cases be better than in the United States.

Latta explained that anytime you have to go back and reopen an initial partnership agreement

after it was already signed you are already in trouble. As a result, they spend a lot of time on the

initial negotiations, including rights for background and foreground IP, and

exclusive/nonexclusive rights of the JV to exploit the IP. Also important is the business strategy,

including management and board structure for how the JV will resolve disputes.

Also discussed on this panel were issues surrounding cultural differences, and how this may

influence differences in understanding terminology. For example, there is a different

understanding or concept of how the idea of exclusivity exists in China and in U.S. contract law.

Even the term “technology transfer” is understood in China to be a very broad concept, including

every form of technology cooperation, whereas in the United States it usually has a much

narrower scope. In addition, there are two types of exclusivity in Chinese law, applying to the

licensee as well as the licensor. It was suggested that cultural differences should inform visions

for the future of the JV, including how different types of disagreements would be worked out in

practice. Another cultural difference comes from perspectives brought to the table. For example,

it is in the nature of many Chinese firms not to think about worst cast scenarios, whereas U.S.

firms tend to be savvier on this point. It may be viewed as overly negative to talk about divorce

when you haven’t even been married yet, and therefore such discussions must be handled

delicately.

He Jing elaborated on the challenges in enforcing trade secrets in Chinese courts. He said that the

judge’s role is quite different from in the U.S. system in that they are responsible for conducting

the discovery process (including going to the factories, examining the data), which requires the

judges to be professional and willing to learn the technical details. It also may be difficult for a

plaintiff to enforce a trade secret if they do not want to disclose it in court, since confidentiality

agreements are rarely used. He believes that the courts are in fact working on this and that there

will be new policies implemented by the end of this year. He mentioned that there are 2-3 very

high profile cases pending in Chinese court and the results could be indicative of future trends to

come.

6. Panel 3: Case Study: Bringing IP from China to the United States

(LEFT TO RIGHT) PING YU, TONY POSAWATZ AND DR. MA JUN

Moderator: Ma Jun, Director of Tsinghua University’s Overseas R&D Management Office

The first case discussed was a partnership between Fisker Automotive and Jing-Jin Electric (JJE)

Technologies called Fisker Karma.

Ping Yu, Chairman & CEO, Jing-Jin Electric gave an overview of their product: the first luxury

electric vehicle (new energy vehicle) with extended range. Fisker makes the motors and this

involves a lot of technology and IP. JJE is a young Chinese firm which developed the eMotor for

Fisker Karma on their own, with co-investment from Fisker. JJE has benefited from a competitive

manufacturing structure and access to rare earth materials. The firms jointly market and sell into

market in other countries.

Tony Posawatz, CEO, Fisker Automotive, gave an overview of their strategy to take technology

from across the globe and bring it together to find a better way for it to solve the problems we all

have going forward. Fisker is a startup founded in Anaheim, CA 5 years ago, and after 4 years

they delivered their first car (The Karma) in the United States, EU and GCC. It will also be

launched in China at the Shanghai auto show, because they view China as a very important and

large market. He said that JJE has been a great supplier, and they expect them to bring

technology, quality and competitive cost. He said that they are willing to take risks, like Fisker, in

technology as well as legal relationships.

A key factor identified in the success of this partnership is that Tony and Ping Yu used to work

together at GM in the past, and as a result have a long-term relationship which has helped the

collaborations between their current firms. Other cultural similarities between the firms were

credited with the successful partnership. They were both financed by venture capital firms. Their

IP agreements were in line with industry norms, and negotiated by a major Detroit law firm that is

involved in most automotive contract law. Both partners also had a shared vision which also

helped the collaboration. They want to be leaders in electric vehicles and overcome the remaining

technical obstacles to the widespread use of EVs. They primarily invest in applied technology

(product engineering) rather than basic R&D, but as they grow they hope to be able to invest

more into basic R&D.

It was also mentioned that collaboration is crucial for the survival of small companies,

particularly if other firms bring IP infringement cases against them. Collaboration was also

identified as being crucial to driving down costs and sharing RD&D costs. Karma received a

DOE loan and has been looking for other partnerships due to the capital intensity of the auto

sector. Fisker looks for a variety of things when assessing new partners, including technology,

price, inherent capabilities (logistics and material control) as well as quality.

Dr. MA Jun, Director of the Overseas

R&D Management Office, Tsinghua

University

Ma Jun elaborated on how Tsinghua handles

international cooperation. She said that

Tsinghua has many international patent

applications and policies to encourage

technology transfer in part to cover the costs

of the patenting process. They also have

incentives in place to move R&D results from

the lab to commercial applications. For

example, if technology is transferred the team

will enjoy 40% of the income royalties. The team’s university department will also get 40%, and

the university takes 20%. The PI gets 50% of the 40% that goes to the team.

7. Panel 4: The Evolving IP Landscape in the United States and China

(LEFT TO RIGHT) ERIK R. PUKNYS, WANG HANPO, MARC COHEN AND HOU QIONGHUA

Moderator: Erik R. Puknys, Finnegan, Henderson, Farabow, Garrett and Dunner, LLP

Wang Hanpo, Beijing Huayi Law Firm, Hou Qionghua, MOST, and Marc Cohen, USPTO

engaged in a discussion about the evolving IP landscape in the United States and China. Wang

began with a presentation that included a timeline of IP protection law in the United States and

China as well as cooperation in this area. Hou discussed the inventor reporting system in China

that is being implemented to better determine ownership of patents and better rewarding

inventions. Cohen said that the U.S. PTO and SIPO relationship is robust, and includes ongoing

discussions on patent reforms as well as ways to streamline patenting processes in both countries

and a dialogue on the economic impacts of IP in our respective economies.

Issues raised by the panel include the differences in the discovery process in China and the United

States. The cost of discovery in the United States may mean it may be cutting back on discovery

while China is ramped up, and therefore there may be a middle ground. Evidence gathering

involving China is confusing for U.S. courts but on substantive harmonization we have made a lot

of progress.

Cohen mentioned that the United States looks to China and China looks to the United States as to

how to change laws. For example, he visited the Suzhou patent office when the United States was

opening satellite patent offices in order to see how China ran them. The United States is also

looking at China’s discovery process as it looks to reform the U.S. process. Hou mentioned that

China amended their own law based on the U.S. Bayh-Doyle act such that IP rights should be

granted to the institutions that actually did the R&D.

Also discussed was the matter of how to incentivize inventors, and how to measure patent quality.

Cohen said that SIPO uses the percentage of service inventions as a measure for quantifying

increased patent quality, because the more patents made in the service of an employer, the more

likely they are to be higher quality patents (particularly utility/invention patents). Overall the

percentage of non-service inventions in China is well in excess of the percentage of independent

inventors in the United States. Also mentioned was the problem faced by U.S. law firms in

researching Chinese patents due both to the large quantity of patents as well as well as language

barriers. Cohen also remarked on the dearth of U.S. law students being trained in Chinese law.

All panelists agreed that a lack of familiarity with each other’s systems was often the root of IP

concerns.

Wang mentioned that there are likely to be upcoming revisions to the copyright law in China.

However, he said that there would not be revolutionary changes to Chinese law, just incremental

changes.

8. Panel 5: IP in International Clean Energy Finance

(Left to Right) Jeff BALL, LI Amin and Gary RIESCHEL

Moderator: Jeff Ball,

Stanford University

Gary Rieschel of Qiming

Venture Partners spoke

about his experience

investing in China in a

variety of sectors including IT, healthcare and cleantech (currently not clean energy but primarily

pollution control and energy efficiency technologies). His company is entirely Chinese nationals

and they’ve put together many joint ventures in China, as well as cross-border deals. They make

many early stage investments, many of which have IP concerns. He mentioned that China has a

lot of financing support for startups, including companies based off another company’s idea. He

brought up the example of Groupon, which he said had launched about 117 copycat firms in the

United States, and over 800 in China.

Li Aimin, of China Venture Capital Co. Ltd. Spoke about his company which was established in

2000. They invest $400 million, most of which comes directly from wealthy Chinese investors,

and is entirely invested in China. They focus their investments on conservation and new

materials, and invested $67.7 billion in the Chinese clean energy sector in 2012.

Rieschel said that LP Amina (discussed on a previous panel) is one of their investments. Others

include LanzaTech, which has a microbe discovered in New Zealand and brought to China in

2009 that eats carbon monoxide from steel mills and could be used to make useful products once

commercialized. Due to China’s role in global steel production, the owners of the technology

decided they needed to demonstrate their technology in China in order to bring it to

commercialization, but they were inexperienced and saw many barriers to making this happen.

They decided to start a joint venture with Bao Steel that involved 9 months of reasonable IP

negotiations. In this case the JV does not own the IP; Bao owns a 70% revenue and profit share of

the commercial product; LanzaTech 30%, and Bao pays LanzaTech a royalty scheme. The

microbes themselves could be reverse engineered, so they were provided in freeze-dried cylinders

in a way that prevents this. It took 18 months in total to negotiate the agreement. He also noted

that LanzaTech has another partnership with Capital Steel, and both Chinese JVs are competing

with each other to see who can commercialize the technology first.

Rieschel also mentioned Bloom Energy as another interesting case. The company makes a solid

oxide fuel cell and has made a huge investment to try to commercialize its technology. Initially

they opted not to bring it to China, but ultimately they decided they couldn’t get to commercial

scale without China. To manage IP they held onto the core IP in Silicon Valley, and source the

rest in China across multiple firms (so no single firm has the full “recipe” for the technology).

Segmenting suppliers was discussed as another model which can be effective for managing IP in

China.

Li mentioned that Chinese firms were not allowed to be publically listed if they had IP

infringement violations. He said that they look at the source of the core technology and whether

it’s being protected sufficiently before deciding whether to invest in the company. He also looks

for redundancy, and that there isn’t just one person that holds all the secrets in case something

happens to them.

Rieschel discussed the problem of U.S. firms that are looking to enter China frequently rushing

the selection of a partner, and that he has seen firms take less care in doing this than they would

with a partner in the United States. He emphasized the importance of spending time in China and

making sure there are common interests, nothing that these days there is no excuse not to do this,

and that laziness in partner selection and diligence leads to problems down the road.

Both firms were asked to mention the “coolest” technology they had invested in. Rieschel

mentioned that in the health care sector they were investing in a Chinese with a non-insulin

human injectable, noting that China has largest population of diabetics on the planet. Another

firm has a cochlear implant for people hard of hearing. Li mentioned a firm they had invested in

that addresses landfill runoff.

Rieschel suggested that China should in fact be the commercialization center for the world, and

that it may be wrong for China to focus on the invention (or “brutal early stage invention end”)

but rather should focus on how to become the best place in the world to commercialize

innovations.

9. Panel 6: Quiz the Lawyers - Business Leaders Seek Counsel

(Left to Right), LIU Yumin, William JACKSON, Professor YU Xiang, Dan LANG and

Dr. Benjamin BAI.

Moderators: William Jackson, Dow Chemical; Liu Yimin, GCL America

This panel consisted of a series of questions asked of the panelists: Benjamin Bai, Allen & Overy;

Dan Lang; Cisco Systems; and Yu Xiang, Huazhong University. The first question dealt with

establishing JVs in China. Bai recommended negotiating how the IP is owned prior to the

beginning of the JV, and ensuring the parent firms own the IP rather than the JV itself, in case the

JV gets dissolved down the road. He also recommended setting up a committee for IP

management. Regarding trade secrets, he recommended establishing an understanding between

yourself and the employees of the JV, otherwise you may not have standing to sue the violating

employees. He suggested a 3-way agreement between you, the Chinese partner and the JV itself.

Lang added that while it is hard to think about your JV not being successful it’s important to think

ahead.

The second question asked about whether to use patents or trade secret protection when dealing

with manufacturing process innovations, whether to patent or use trade secrets. Lang responded

that they must decide whether to seek patent protection, with the cost being public disclosure,

within 18 months. Costs often prohibit applying for patents in every country, and there is

variability in the strength of the patent systems in various countries. He referred to “prior user

rights” within patent law as a way to hedge bets with trade secrets. If someone else

simultaneously develops the same trade secret or files a patent off your trade secret, you can get

sued for something you invented but kept to yourself. This is one form of protection is weaker

than other aspects of IP law, and therefore this encourages people to file for patents over relying

on trade secrets. Yu Xiang added that a key element for CERC is setting up a way to mitigate the

risk of IP disputes among partners. In addition, it is important for any license agreement to detail

exactly what is being licensed.

William JACKSON, Dow Chemical

Company, comments as LIU Yimin listens.

The third question raised the issue of

background IP, for example when a company

hires an employee that brings in expertise from

a previous position. Jackson mentioned that

frequently when employees bring secret

information to a new company that violates

trade secret protections or other internal

information, the new company does not want to

be sued so may be willing to cooperate where the employee is concerned. In a case of this

experienced by Dow, the company opted to terminate the employee and the manager was

punished, so that they could avoid a lawsuit. Bai added that sending a letter to the hiring

company noting that there is a problem gives them liability, so notifying them is important. He

agreed that most of the time companies will do the right thing once you initiate this process. He

added that non-compete clauses are generally hard to enforce in California, it they are valid and

enforceable in China for up to 2 years, and are in fact much easier than enforcing trade secrets.

Liu brought up the issue of “easy IP,” IP that can be easily copied. He noted that many small

companies are scared to bring “easy IP” to China, even if they may have meaningful applications

there (for example could make significant environmental impact). Both Bai and Yu noted that

easy IP cases are also easier to win in litigation, because it is easier to provide evidence and win

in court. Because of this, Bai said that he believed companies should always bring the best

technology to China. For patentable technology this is a “no brainer” because it’s already

published. For trade secrets, you usually still should, because you “don’t want the IP tail to wag

the growth dog.” He mentioned General Motors, saying that if GM did not take a leap of faith in

bringing its car technology to China it would not be where it is today. It’s not so simple that if

you bring your best technology to China you will lose it. You need to take special precautions.

And you can enforce simple designs more easily as previously mentioned. He noted that the win

rate in Chinese courts is about 80%. While this does not mean it’s easy to litigate in China, he

believes that if you persist and understand the system you can win. But, you do need to factor the

cost of IP enforcement into your business plan, because you will have infringement. Lang agreed

and said they have not had to hold back IP in their large R&D presence in China.

The panel then discussed the CERC’s TMP and how it affects company IP strategy in China.

Jackson said that the TMP was “pro-ownership” on behalf of the company doing the inventing,

and that the TMP offers a lot of comfort to companies that have joined the CERC. Yu added that

any new contracts signed between participants should follow the guidelines of the TMP.

10. Panel 7: Resolving IP Disputes in the United States and China

Left to Right: Professor Colleen CHIEN, Geoff BARKER, LIN Dongping and Frank LANDGRAFF

Moderator: Colleen Chien, Santa Clara law school.

For this session, panelists Frank Landgraff, GE, Lin Dongping, Mindray Biomedical Electronics

Co. Ltd., and Geoffrey Barker, RPX Corp., discussed how to resolve IP disputes in China and the

United States. Frank Landgraff from GE discussed how he has been on both sides of such

disputes as the plaintiff and the defendant. As most of his cases have been in the U.S. federal

district court, he expressed frustration with the U.S. discovery process and the associated costs.

He also noted that this process is much more costly today than a few years ago. He has also

participated in ITC process in the United States, which he noted was quicker than most federal

district courts in part because you initially try the case to an administrative law judge with good

patent expertise. He also mentioned that several new processes are being implemented at U.S.

PTO for patent litigation, and that the judiciary is taking note of these companies about cost of

discovery. For example, there is a patent pilot program in 14 district courts that allows specific

judges with patent expertise to take more cases.

Lin Dongping discussed a case that he was involved in where the company that infringed agreed

to settle and compensate for our loss. He said that he thinks, compared with U.S. administrative

proceedings, the Chinese system is more consistent. In the United States, as a startup company we

collaborated with GE and a big company in Japan. He said that their strong IP, in addition to the

fact that several lawsuits had ruled in their favor, positioned them well for strategic

collaborations. He noted that in China, the success rate for mediation is not that high, and it is

difficult to get companies in China to admit to infringement in front of the government. He

believes that administrative enforcement in China is quite effective and efficient on the whole.

However, he also said that the only way to win an IP infringement case is to outperform your

competitors, because you cannot win in court in China.

Lin also noted that patent filings in China are directly encouraged by the government, in that the

more patents you file the more subsidies you get from the government. He believes this is the

reason behind the massive growth in patent filings in China.

Geoffrey Barker recapped his professional history and how it has informed his experience with

patent litigation. At RPX, they buy license rights and all companies buy into their patent pool and

get the benefits of this. He said that since everybody is suing everybody these days, the only

people who are winning are the litigators. He believes that there is an opportunity within the clean

tech space has to learn from the experience within the communication technologies sector which

is experiencing an explosion of litigation. He mentioned that it is common for such companies to

have more than 50 cases on the docket at any given time. He noted that the clean energy sector is

seeing an explosion of patenting activity. However, many of these firms will ultimately fail, and

lots of patents will be released into the ecosystem, establishing a fertile ground for future

litigation. He suggested several options that could help to prevent this, including 1) increased

industry cooperation to deal with defensive patenting, such as buying up patents that pose

litigation risks to multiple companies and taking them off the market; 2) looking at a rational

model for cross-licensing to address overlapping patents, including establishing a way to

determine a methodology for adjudicating such overlaps, potentially saving the companies

involved extensive litigation in the future.

Regarding the issue of non-practicing entities (NPEs), Lin mentioned that NPEs cannot sue in

China without evidence of a loss of interest, and recommended that the U.S. system might

consider this. Barker noted that more and more NPEs are litigating in Germany.

The question of whether foreign firms can get fair treatment when litigating in a foreign venue

was raised, whether in the United States or China. Lin responded that firms should not be afraid

of litigating overseas, and that being a good corporate citizen is also important. Landgraff added

that often Chinese firms may not understand the U.S. legal process and this may lead to a belief

of not being treated fairly. The same scenario may be true for U.S. companies litigating in China.

Day 2

1. Welcome

Mary Elizabeth Magill, Dean of Stanford Law School, welcomed the participants for day 2 of the

conference, noting that this was the right place for this conversation to happen, and that we are

taking about the right issues.

STAN BARER STAN BARER

Stan Barer, founding co-chair of the U.S.-China

Clean Energy Forum, also welcomed the

audience. He noted that IP is the confidence

builder for our engineers to develop the

technology we need to protect our planet for

future generations. He believes that the CERC

leaders share the vision that IP was important

enough to spend the last year planning this

conference. He thanked everyone for helping to make this very important process work.

2. Opening Keynotes

David SANDALOW. Acting

Undersecretary and Assistant

Secretary for Policy and International

Affairs, U.S. Department of Energy

David Sandalow. Acting Undersecretary

and Assistant Secretary for Policy and

International Affairs, U.S. Department of

Energy, opened the second day of the

conference. He had come directly from

the ARPA-E summit in Washington on

energy innovation, and noted that energy

innovation had been a major priority of

DOE and for Secretary Chu over the last

4 years. He said that the protection of IP

is a large part of what encourages innovation, and it has led to the creation of many companies

around the world. The United States has a thriving R&D industry that makes breakthroughs

because of a strong IP framework that encourages individuals to take risks, and allows others to

access their knowledge through legal means. He noted that while laws are important, they are not

enough, and that enforcement is necessary for IP protection.

Recalling the launch of the CERC, he said that it now provided a foundation for the U.S.–China

relationship. He said that the foundation for IP protection is strong and it provides a basis for

cooperative and productive work between our two countries that can be a model going forward.

He noted that what has been produced in the IP arrangement under the CERC is a great

achievement. He mentioned cyber security as well as a high profile ongoing IP dispute between

U.S. and Chinese wind companies, and called for a swift and acceptable for both sides.

Reminding the room about the key strategic relationship between the United States and China,

and the central role of energy and innovation, Sandalow said that we must leverage our strengths

in science and technology to make a better life for our people, and to build mutual respect.

When asked about the shale gas revolution, he said that it is having dramatic implications in the

United States and increasingly will around the world, and noted that DOE played an important

role in the 1970s and 80s in supporting R&D investments in hydraulic fracturing and horizontal

drilling technology. There may be technologies they are investing in today that could have the

same potential for revolutionizing global energy 20-30 years from now.

DR. JIN XIAOMING, DIRECTOR-GENERAL,

DEPARTMENT OF INTERNATIONAL

COOPERATION, CHINA MINISTRY OF SCIENCE

AND TECHNOLOGY

Jin Xiaoming, Director-General, Department of

International Cooperation, China Ministry of Science

and Technology, thanked the workshop sponsors, as

well as the government agencies, research institutes

and business community in the United States for

supporting CERC. He said that much progress has

been made since the launch of CERC. He called

CERC the most innovative collaborative R&D

agreement since the signing of the China-U.S. S&T

Agreement. He noted that the mid-term review

completed last month was successful, and that he expects that substantial progress can be

achieved in terms of knowledge, technology and commercial application. He encouraged new

business partners to join in the consortia.

Since 1979 when Deng Xiaoping visited the United States and signed the first U.S.-China S&T

Agreement, over 50 MOUs and agreements have been signed, and 14 bilateral S&T meetings

have been held. CERC joins these other bilateral frameworks in driving bilateral innovation

efforts, and he hopes that the CERC model can be expanded to other areas in the future, including

agriculture and health. He suggested future S&T activities for cooperation between the United

States and China including an innovation fund, an innovation park, an innovation research center,

and a technology trading market. He noted China had already established 10 national-level

innovation parks, each with a specific field or subject (including a U.S.-China collaboration in

Wuxi).

(Left to Right) David

SANDALOW and Dr.

JIN Xioming take

questions from the

audience.

3. Panel 1: Tools for Capacity Building

(Left to Right) Pamela

PASSMAN and

Professor YU Xiang

Pamela Passman. Center

for Responsible Enterprise

and Trade (CREATe.org)

spoke about her work

developing IP strategies for

companies. As the deputy

general counsel for

Microsoft for 15 years, she has come to appreciate the complexity of IP protection. She noted that

when it comes to IP protection, governments are key stakeholders, and that IP laws are

increasingly consistent around the world. Many large U.S. companies have spent decades

developing sophisticated systems to appropriately manage and use IP, which cuts across

numerous business functions (no just the lawyers). As an IP protection program matures, the

scope and risk assessment process can become broader and deeper, ideally across the supply

chain. This may include working proactively with supply chain members, and integrating IP

practices into contracts, as well as making IP protection part of due diligence for selecting new

partners and evaluating current partners.

She noted the issue of trade secret theft and there are specific actions companies can take to

manage it. Ongoing training and capacity building are needed so that employees and business

partners are aware of the rules and how to follow them. Continually improving IP protection

requires monitoring and measurement for levels of compliance. And when problems are

discovered, continual improvements across the organization should be made. Her company shares

leading processes for how companies do this with a three-step program. They are currently in a

pilot phase so are waiving fees to participating companies.

Yu Xiang, Huazhong University, suggested that a supportive government environment for

innovation is important, as well as capacity building and basic education on IP at all

universities—not just law schools—was important, and particularly in engineering and business

schools. He showed a model of a Swiss firm and now it incorporates IP management across the

firm. He noted that IP Strategy can also improve the competitive advantages of enterprises.

The speakers noted that every single company in the world must deal with trade secret theft or

piracy in some aspect of their supply chain. So it’s not a question of if this will happen but rather

how to manage it.

4. Panel 2: Trade Secret Tutorial

Moderator: Stacy Baird, U.S.-China Clean Energy Forum

Panelists Wang Hanpo, Beijing Huayi Law Firm, and Benjamin Bai, Allen & Overy, discussed

issues related to trade secret protection.

WANG Hanpo, Beijing Huayi Law Firm

Wang’s presentation gave a history of China’s legal

system for trade secret protection, clarifying that trade

secrets protection has in fact been part of Chinese IP

law for a long time. He noted that the earliest form of

trade secret protection in China as in the 1980

regulation on joint ventures. 1993 was also an important

milestone for trade secret protection in China with the

launch of the unjust competition law. He noted that an

amendment to include protection of trade secrets has

been submitted but nothing has happened so far. He said

that the Chinese model for trade secret protection is gradually integrating with international

standards. He referred to trade secrets as hidden weapons of the IP innovation game.

Bai said that in the United States, trade secret cases are won about 40-50% of the time. In China,

not enough data for a meaningful conclusion, but he approximates 46-60%, and higher in some

second-tier cities. He also noted that of 60,000 IP cases filed, only 400-500 trade secret cases

filed. While the concept of a trade secret is the same in the United States and China (information

with some economic value subject to confidentiality measures) there are some differences in how

they are enforced. China does not have U.S.-Style discovery. And in the United States there is no

civil liability, only criminal, it is primarily handed at the state level. He also noted that in China,

oral testimony is acceptable but in practice it carries little to no weight. Evidence is primarily

written, but it must be the original documents—no copies. If you cannot show the original NDA

you do not even have a case. There is also a rule that in the United States you cannot withhold

adverse evidence, but not in China. In China it is important to create a paper trail in China to

protect your confidential information.

Dan Reicher, Executive Director, Steyer-

Taylor Center for Energy Policy and

Finance, Stanford University, poses a

question to the panel.

Bai suggested some best practices for

protecting trade secrets in China including

implementing and enforcing a trade secrets

policy; taking measures to guard secrecy;

using confidentiality agreements; obtaining

written acknowledgement for confidential information; employee education/exit interviews; and

building relationships with the police. He noted that the two most common ways trade secrets are

lost are emails and USB drives, so the simple solution is to disable your USB drives (this alone

will eliminate 50% of trade secret losses). While this may go against some corporate culture, it is

worth considering if your secret is important. He also suggested that companies monitor non-

work related emails, and have a warning system when there is an attachment in an email sent to

an outside company. Also recommended not immediately reassigning your laptops and computers

after an employee leaves so you’ll have evidence on hard drives and can establish a chain of

custody. Judges will want to see steps you have taken to protect your trade secrets so it is

important to have these in place.

Panel 3: Licensing Tutorial

LEFT TO RIGHT: DR. LIU SHAN, DR. MA JUN, DR. TOBY MAK AND LUIS MEJIA.

Moderator: Ma Jun, Tsinghua University

Panelists Liu Shan, Huazhang University, Toby Mak, Tee & Howe, and Luis Mejia, Stanford

University, discussed issues related to licensing IP.

Liu Shan noted that when licensing background IP you need to make sure you do not violate

China’s anti-unfair competition regulations, including when drawing up rights to license back

improvements to the background IP owner. For the CERC, participants should negotiate a non-

exclusive license in good faith terms in line with the TMP.

Toby Mak, Patent Attorney, Tee and Howe, said that technology transfer in and out of China is

governed by Chinese patent law and the “Administrate Regulations on Export and Import of

Technologies.” This covers not just patents but also trade secrets and copyrights. There are two

categories of technologies that require official approval by committee, including forbidden

technologies and restricted technologies. He also noted that there are different kinds of

exclusivity in a Chinese license: truly exclusive (also excluding the patentee) or only excluding

3rd parties (meaning the patentee is also allowed to practice the invention).

Mak noted that inventions completed in China must obtain clearance before filing for a patent

outside of China. If you fail to comply, your Chinese patent rights may be in danger (refused or

invalidated). Further, if you do this and the invention concerns national security, then criminal

charges could be involved.

Mak also pointed out some default clauses in Chinese agreements, which can be changed if

desired, that are generally not welcomed by business, for example default first-right-of-refusal to

inventor(s) when selling a patent, and co-owners of a patent can license the patent without each

other's consents.

Luis Mejia from the Office of Technology Licensing at Stanford University noted that licensing

with a university has more restrictions than with companies. Since most of Stanford’s research

support comes from the federal government, the Bayh–Dole Act applies. They primarily engage

in basic research, but if something comes out of it, the university then must decide whether to

protect that piece of IP. It may decide to file a patent application to help facilitate the transfer of

that technology. Exclusive licensing may be necessary to help that technology get

commercialized. Stanford has a process by which they market their inventions. Royalties will be

paid to the university and that will go to further the mission of the university. He noted that

licensing is difficult and takes a long time, and that energy technologies in particular require

significant capital for scaling.

Meija said that Universities generally own inventions made on campus jointly with collaborators,

and that the University wants to do what’s best for the technology, which is usually to transfer it

for public use and benefit. He noted that each university has its own royalty sharing rules. For

Stanford: 15% off the gross royalties offset licensing costs; then the remaining 1/3 of the royalties

to go inventors; 1/3 to the department; and 1/3 to the school. He noted that all universities

generally share royalties with the inventors.

5. Panel 4: Quiz the Lawyers – Researchers Seek Counsel

(LEFT TO RIGHT) DR. S. JULIO FRIEDMANN, DR. HUANG YUEHUI, DR. LU XIAOJUN,

DR. TIEFEI DONG, DR. ROBIN CHIANG

Moderators: Julio Friedmann, Lawrence Livermore National Laboratory; Huang Yuehui, Chinese

Society for Urban Studies.

The panelists, Lu Xiaojun, Tsinghua University; Tiefei Dong, University of Michigan; and Robin

Chiang, Lawrence Berkeley National Laboratory; answered questions from the moderators and

the panel on practical aspects of doing research in the CERC.

Friedmann noted that the value of cleantech is in deployment, and that while each CERC

technology area is covered by one protocol, the nature of the projects and the technologies are

different. This means that all the CERC participants likely think differently about how we make

partnerships and protect our inventors.

Several of the CERC participants noted their progress towards commercialization. Huang said

that they are working with LBNL in the buildings CERC and are trying to commercialize the

results of their research. Lu Xiaojun noted that the partners in the vehicles CERC are encouraged

to discuss the IP issues before the agreement is established. He said that each side has nominated

one party to represent the interests of the Chinese entities and one to represent the interests of the

U.S. entities, and they will manage the patent application process and licensing in each country.

Some concern was raised that this separation was not necessary under the framework of the TMP.

Robin Chiang noted that the determination of who owns the IP is based on the vendor in U.S.

law. He gave examples of how ownership over inventions would be determined within the CERC.

For example, if software is produced by Berkeley Lab, the lab would be the sole owner. But if a

Chinese company contributed code, the final product would be a joint work, so they would be co-

owners. The philosophy of the lab is that it is a non-profit, and so it does not commercialize their

inventions, and they make sure distribution is for the public good.

An example was given where a U.S. research university invents a solvent for CO2 capture. They

partner with a U.S. company that designs the reactor that retrofits power plants and the company

wants to demonstrate this technology in China. Through the CERC they identify prospective

companies to do this. What’s the best structure of an agreement to protect the IP? Dong

responded that they would first work with the U.S. company that has the reactor to see the field of

use of the solvent, and whether they should give a non-exclusive license to that company. Then

the U.S. Company should decide what’s in their best interest for the Chinese partnership as

relates to their strategy in the Chinese market. There would also be sublicensing language in their

agreement with the company in the case they decide they no longer want to be involved, so that

they can sublicense to a Chinese partner. This would be pre-defined and reflected in the original

license with the U.S. company. The agreement would likely also have clauses to make sure the

company actually takes steps to get the product on the market.

A question was raised about the CERC TMP, and how it allows for a U.S. party to license in

China or vice versa, such that inventors are not restricted to license only in their own country.

Such a restriction would revert us back to the S&T agreements we’ve been operating under for

the last 30 years. Lu noted that it was often simpler for the local party to handle the local market

in which they are familiar, and to evaluate the IP strategy within that region. Dong explained that

in their joint IP management plan with Tsinghua and Michigan, each side gets options for IP from

the other side, but they needed a default to refer to when issues over IP arise and focal points on

each side to address this. Dong noted that the parties involved in the CERC still have a say in

how the patent will be filed.

6. Panel 5: CERC Clean Energy IP Update

(LEFT TO RIGHT) STACY BAIRD, AND PROFESSOR YU XIANG

The final panel of the conference featured Stacy Baird and Yu Xiang giving an update on the

CERC’s IP program. Baird said that they were in the process of producing a joint handbook for

the CERC teams based on the widely adopted University of Michigan IP handbook to address IP

and technology transfer in the United States and China. The handbook describes the law in non-

legal jargon and provides guidance for SMEs and researchers for how to address various issues.

In addition, the U.S.-China Clean Energy Forum has put together a new website and blog that

aims to connect the CERC participants with useful IP information: http://ipknowledge.org/.

They have also developed a CERC IP Experts Group under MOST and DOE to identify real IP

issues among CERC participants and develop solutions to those issues. This group will conduct

interviews and surveys to understand the needs of the CERC participants and identify potential

solutions to the problems. They expect that this will include everything from enhancing

confidence in doing joint research to enhancing innovation, as well as clarifying legal relations,

IP education, and providing appropriate consulting services. Yu asked the researchers within the

CERC to identify any challenges they are facing with respect to IP and approach the experts

group with questions.